What Does Forex Spread Betting Mean?

Wiki Article

Top Guidelines Of Forex Spread Betting

Table of ContentsForex Spread Betting Things To Know Before You BuyGetting The Forex Spread Betting To WorkSome Ideas on Forex Spread Betting You Should KnowThe Facts About Forex Spread Betting Uncovered

This is just how much you can make or lose on a spread bet for every single point of activity in the price of the market. It is additionally referred to as the risk dimension. This refers to the closure of a placement, and also the end result identifies whether you have actually earned a profit or a loss.

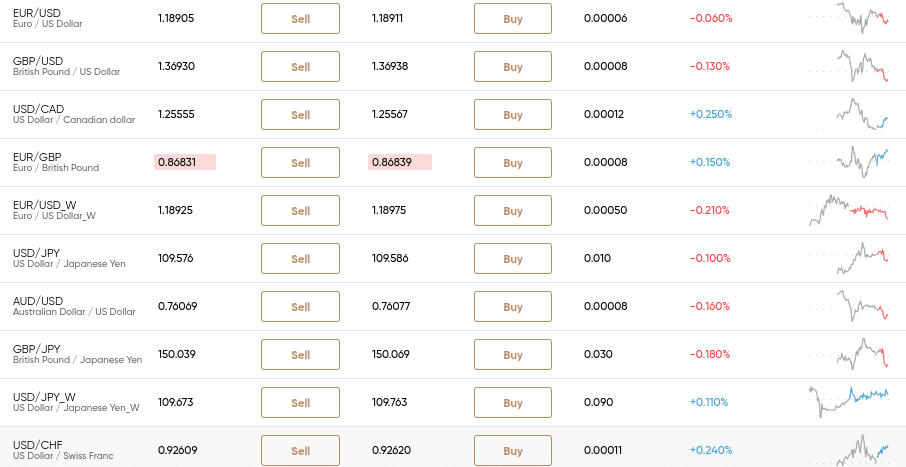

during rounds of extreme volatility, when prices relocate dramatically up or down. The spread is the distinction between the 2 estimate on every spread bet: the buy and sell price for the same property. Frequently shortened to DFB, this term defines a placement that continues to be open until you decide to shut it.

Getting My Forex Spread Betting To Work

If you believe a property is mosting likely to climb in price, you can buy a setting because asset via a spread wager. This is referred to as going long. By contrast, if you assume the cost is going to drop, you can sell the spread wager. This is referred to as going short.

A margin call is made when the equity in your account the overall funding you have actually deposited plus or minus any type of profits or losses goes down below the minimum need. If this holds true, there is a threat that the broker will immediately close your positions, potentially leaving you with losses.

The spread is the distinction between a broker's sell and also buy (quote as well as offer) costs. This is how the broker makes its earnings. The hidden property's worth will be in the center of these two prices. If the FTSE 100 index is at 7100, a spread-betting company may price quote a spread of 70997101.

What Does Forex Spread Betting Do?

As a whole, anchor the smaller the spread the much better, as you need the price to move much less in your direction prior to you start making a profit. There are a number of spread-betting strategies that can be released. Browse through to find out more on techniques and also a broad array of added instructional material.Arbitrage involves the synchronised acquisition and also sale of the same property in various markets in order to benefit from small differences in the rate. Spread betters do this when short-term activities by buyers and also sellers at a particular broker differ from those at an additional, causing different rates (forex spread betting). While see page the quotes detailed on broker internet sites show the underlying cost activities in the instruments they are based upon, they are not always similar.

This method involves trading based upon news and market assumptions, both previously and complying with news launches. You will need to act swiftly as well as be able to make a fast reasoning click this site on just how to trade a new news or piece of information. You will certainly also need to have the ability to judge whether the news is already factored right into the stock price and whether the information matches investor assumptions.

The drawback is that you require considerable competence in just how markets operate as well as how to translate information and also information - forex spread betting. According to the broker CMC Markets, this design of trading calls for much less time commitment than other trading strategies since there is just a demand to examine charts at their opening and closing times.

Forex Spread Betting for Dummies

The approach concentrates on researching the existing day's price compared to the previous day's price movements, and using that as an overview to exactly how the marketplace is likely to move - forex spread betting. Investors can make use of different tools to restrict their overnight risk, such as establishing a take-profit order or a stop-loss restriction.They count on indications to figure out when a trend is taking hold and also then trade on the basis that that trend will certainly continue. Technical-analysis investors start by looking for to understand where the rate is heading according to the basics of supply as well as demand.

In an uptrend, a line on the chart attaching previous highs will act as resistance when over the existing degree, while a line connecting previous lows will act as assistance with the reverse true in a falling market. Swing trading is a style of trading that concentrates on short-term trends in an economic instrument over a period of a couple of days to several weeks.

If this is done regularly with time, relatively little gains can intensify into superb annual returns. Swing traders must concentrate on the most actively traded supplies that reveal a propensity to turn within wide, distinct limits. It's a great idea to concentrate on a choose group of economic instruments, and monitor them daily, so that you recognize the price activity they usually show.

Report this wiki page